“Aviation and Competition Law Research” founder Daniel Metz recently published an article about competition in the aviation industry on airliners.de – the leading German speaking aviation industry portal. Click here to read the German version on airliners.de or read the english translation below:

Aviation in Europe: Competition at any price?

From the point of view of competition policy, the current competition in the aviation industry is exemplary. Consumers benefit from low ticket prices and inefficient airlines are forced out of the market in order to initiate the necessary market-economy regulatory processes. But is our idea of “competition” still contemporary?

The aviation industry is booming and attracting consumers with cheap tickets. Especially in the DACH region, where many low-cost airlines are represented with Eurowings, Easyjet, Laudamotion, Level, Ryanair, Vueling and Wizzair, competition among airlines is tougher than ever. But for industry experts such as Wizz Air founder József Váradi, it is clear that this brutal competition cannot be sustainable and that flying will become more expensive in the future. This is also illustrated by current developments: Ryanair issued its second profit warning since October and is putting the brakes on growth, Norwegian is implementing an ambitious savings programme and Austrian Airlines is also changing its route network to save costs in the long term. Lufthansa CEO Carsten Spohr and Ryanair founder Michael O’Leary are already predicting a market shakeout in the aviation sector this year. Small airlines in particular are at risk. The major players in the industry, on the other hand, are waiting for the moment to take advantage of takeovers to expand their leading position on the international aviation market in the long term. An oligopoly has long been a reality in the USA, where the five largest airlines have a combined market share of just under 90%. The competition authorities are also preparing for the coming consolidation, but fear increased political influence.

Competition policy and the concept of competition

Competition policy is one of the most important areas of state regulatory and economic policy. The main purpose of antitrust law is to ensure and protect effective competition in the interests of consumers and businesses. However, a rational and science-based competition policy requires a clear and coherent agreement between political and economic actors on what “competition” is. However, the supposedly easy answer to this important question is more complex than one would expect and basically not conclusive, since the ideas of competition, parallel to the current economic and social order, are in a constant process of transformation. Already in the last centuries different economic models were founded and developed with the classical school of national economy and the theory of the complete competition and the welfare optimum.

It was from these considerations that the three schools of thought – the Harvard School, the Chicago School and the Austrian School – that emerged in the 20th century and are still valued today. While the Harvard School is guided by the concept of workable competition, according to which competition should satisfy certain economic models (distributive justice, consumer sovereignty, etc.), for the Chicago School only consumer welfare in the sense of economic efficiency is decisive. The Austrian School, on the other hand, regards competition as a method of discovery. The core of the competitive process is ultimately the rivalry between companies. In contrast to the Chicago School, however, the Austrian School focuses on the freedom of competition itself (and less on efficiency).

“More economic approach” in European competition policy

Since the beginning of the 2000s, the European Commission has increasingly followed a “more economic approach” in implementing its competition policy. According to this (in part strongly criticised) approach, economic models should be increasingly used in decision-making in competition law proceedings. Accordingly, it is no longer competition per se (as a discovery procedure) that should be protected, but the benefit for consumers that should be in the foreground. A merger of companies is to be prohibited in particular if it is highly likely to lead to rising prices and/or falling quality. A typical example of the application of the “more economic approach” is the prohibited merger of the airlines Ryanair and Aer Lingus, which failed for the third time in 2013. The long procedure was characterised above all by econometric expert opinions of the parties involved, some of which were clearly contradictory. Finally, the merger was unsuccessful because the Commission feared that the merger would lead to a reduction in supply and higher prices for air travellers.

Modus Operandi of the European Commission in merger proceedings in the aviation sector

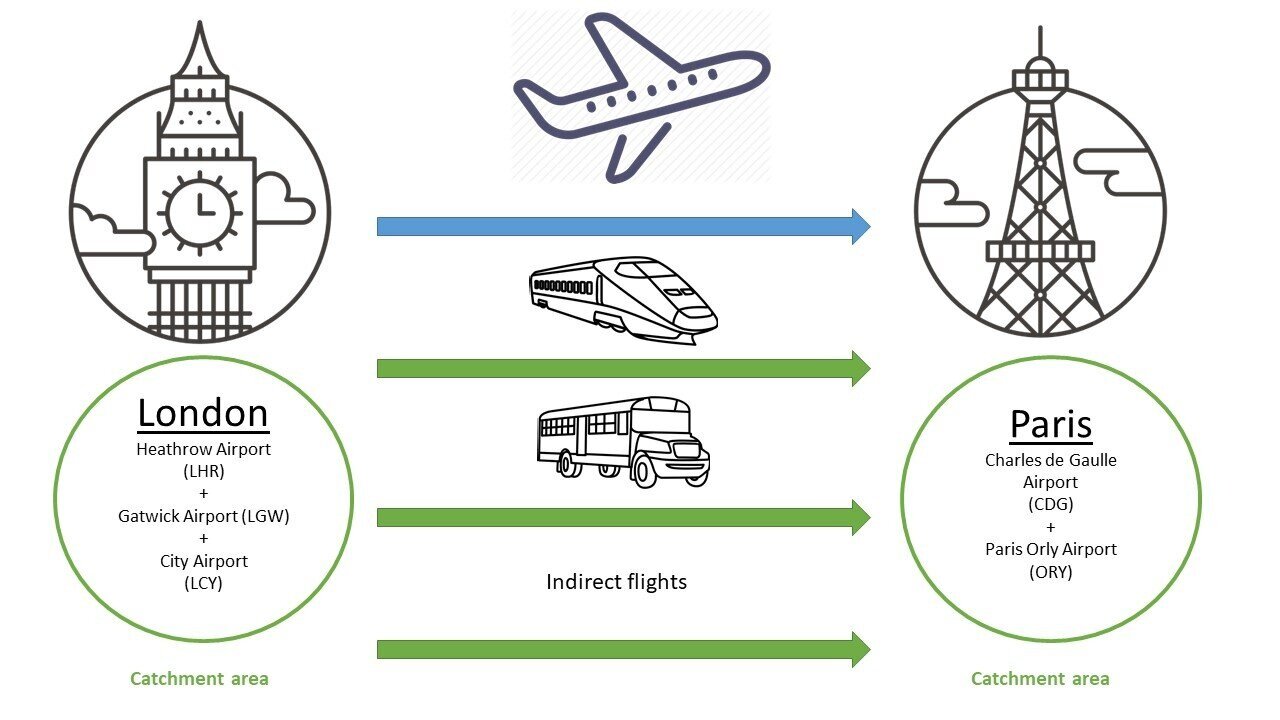

The European Commission takes a fundamentally positive view of consolidation in the European aviation industry, but examines concrete mergers of airlines very carefully and generally requires the companies concerned to comply with a number of commitments which they must comply with after the merger in order to minimise the risk of restrictions of competition. The starting point for any merger control is the definition of the relevant market. The Commission and most national competition authorities use a route-based analysis, the so-called “point of origin / point of destination (O&D) pair approach”. Accordingly, from the consumer’s point of view, each individual route (e.g. Vienna – Frankfurt) is treated as a separate relevant market. In individual cases, several airports can also be combined to form a catchment area. In a previous merger procedure, for example, the three London airports of Heathrow, Gatwick and City were considered to be a single point of departure.

The Commission then focuses on the overlapping routes of the airlines concerned, analysing both the current market situation and potential negative effects on competition. In many cases, the Commission extends its classic route analysis and also examines whether other means of transport (car, train, ship or connecting flights) might be an alternative for consumers. The Commission may also subdivide the markets further (long-haul and short-haul, charter and scheduled, business and leisure). Network carriers, on the other hand, argue that a route-based analysis of the market is not effective and that instead, from the point of view of the suppliers, the network of routes should be used. However, the Commission and most competition authorities reject this network approach, as it is in many cases irrelevant to the individual consumer (who simply wants to get to his destination) whether the airline in question has a global network of different routes.

In large merger cases, which may have potentially negative effects on competition, competition authorities typically require that parts of the business have to be sold in order to reduce the risk of monopoly formation. In the aviation industry, such an approach is generally not effective, as airlines are very flexible in their offer planning and can adapt quickly to new market conditions. For this reason, the competition authorities focus primarily on keeping market access open for competitors on problematic routes or at contested airports. The airlines concerned are therefore in many cases obliged to surrender certain slots or reduce their frequencies.

Merger control after Air Berlin insolvency

The individual acquisition processes following the Air Berlin insolvency in 2017 were similarly difficult for the competition authorities and the airlines involved. The takeover of the Air Berlin subsidiary Luftfahrtgesellschaft Walter by Lufthansa was approved by the Commission under strict conditions after the previously planned takeover of NIKI by Lufthansa was abandoned. Among other things, Lufthansa had to surrender take-off and landing rights at Düsseldorf Airport and surrender aircraft already purchased from Niki to Niki buyer Laudamotion. On the other hand, the Commission approved unconditionally Easyjet’s acquisition of another part of Air Berlin.

From the point of view of the competition authorities and consumers, the consistent application of merger control was clearly successful in these cases, at least if one thinks within the current view of competition and adopts its regulatory and evaluation apparatus. A good two years after the Air Berlin insolvency, consumers are again benefiting from low ticket prices. According to a report by the Bundesverband der Deutschen Luftverkehrswirtschaft (Federal Association of the German Air Transport Industry), prices are currently even at their lowest level since 2012. According to the Bundeskartellamt, a previously determined price increase of 25 to 30 % for Lufthansa flights was related to the sharp decline in capacity on the affected routes triggered by the insolvency, which subsequently led to lower prices due to the market entry of Easyjet and other players and the associated increase in supply. The Vienna – Berlin route can also currently be purchased for an unbeatable 50 euros (return flight). Is the liquidation of Air Berlin’s insolvency therefore an exemplary example of the functioning of current competition policy in the aviation sector?

Towards a more sustainable approach?

At any rate, if consumer welfare in the sense of economic efficiency is placed at the forefront of state competition policy, a number of things have recently been done right in European air transport. But should consumer welfare and ultimately price be the primary evaluation criterion of competition? In view of the low air fares, especially in relation to alternative means of transport, the question could be raised as to whether flying is currently not too cheap? This question should also be accompanied by a rethink of the concept of competition and the maxims of low prices and maximum consumer benefit. Another economic problem of low fares is that they can indirectly lead to the exploitation of the monopoly on certain routes. The core of this problem lies above all in the low profit margins in the aviation industry: in order for airlines to be able to compete at all with other airlines through low fares, they have to raise prices on routes where they have a quasi-monopoly in order to be profitable in the long term.

So do we need a new social discourse about what our idea of functioning competition looks like? Competition policy considerations may need to take even greater account of criteria such as the durability of competition or the impact on the environment and society. Similar considerations are currently taking place in another case, namely the prohibited merger between Siemens and Alstom. While the Commission took a critical view of the merger of the industrial giants and consequently prohibited it, political actors argued with the importance for jobs and Europe’s position in global competition.

USA as a role model?

With regard to future merger proceedings in the aviation sector, competition authorities could, for example, focus more on whether potential purchasers will retain jobs, use environmentally friendly aircraft types or have the necessary capitalisation to survive in the face of fierce competition in the long term. The oligopolistic market structure of the US aviation market in particular could serve as a role model here. According to a theory of competition, competition between fewer, but economically strong, airlines should in any case be more stable than competition between many small, but weak airlines.

After years of economic crisis, the US airlines in particular are in a better position than ever before. Contrary to the opinion of many economists, the painful market shakeout in the USA had positive effects. The major players in the industry, such as American Airlines, Delta and United Airlines, have been able to start long overdue transformation processes through the bundling of capital as a result of mergers. This period of economic regeneration benefited not only the major airlines themselves, but also consumers by increasing the capacity of seats offered and investing in new aircraft and services. The European competition authorities, which are still increasingly pursuing the diversity approach, do not have to fear possible mergers of large European airlines. Ultimately, the only important thing is that (as has been the case up to now) the merging airlines will be required to make strict commitments and that new competitors will continue to be allowed to enter the market.

In terms of competition in the aviation industry, the USA could also set an example in other respects. With regard to possible reform efforts, the German Monopolies Commission proposes a comprehensive change to the system for the allocation of take-off and landing rights. Currently, a company that uses these rights remains in possession of the rights and can only dispose of them to a limited extent. In the view of the Monopolies Commission, the slots should be auctioned in a similar way to telecommunications frequencies. In the USA, an auction of take-off and landing rights has long been common practice. This may well be one of the reasons why there is still intense competition between airlines in the oligopolistic US market. Achim Wambach, Chairman of the Monopolies Commission, also recommends investing the proceeds of the auction in air traffic again (for example in airport infrastructure). This idea is to be supported in principle; if necessary, part of this revenue could also be channelled into state funds and used for environmental protection measures or research projects on resource-saving and low-emission technologies. This would benefit society as a whole and if flying would become more expensive as a result, then this may also be the case.